Jeff Pabst, CRC

Last year, Missouri law was amended to expand LAGERS’ participating employers options for employee contribution to a 0%, 2%, 4%, or 6% election. Previously, an employer could only elect a 0% or 4% employee contribution amount. Since then, we have received a number of calls from members and employers about this new option. One common theme of these calls has been members wanting to increase their LAGERS’ contribution amount. However, they are disappointed when they find out that paying more in employee contributions doesn’t always directly result in better benefits.

This is a common misunderstanding among LAGERS members because many of us have been conditioned to think that if we put more money aside for a purpose (retirement), we will have more assets available. However, LAGERS is not an account balance plan; we are a defined benefit plan. Even if you are contributing and accumulating a Member Account Balance, your contributions to LAGERS do not have a direct impact on the amount you will receive in a future monthly benefit.

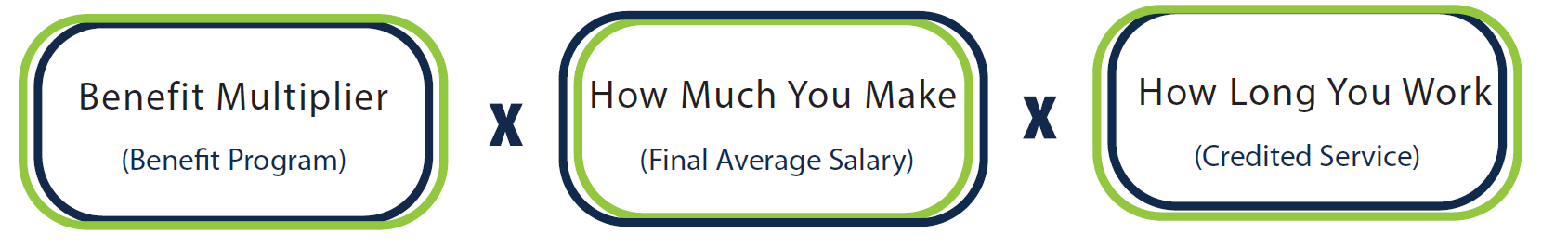

How long you work, how much you make, and a multiplier elected by your employer has a direct impact on the benefit you will receive from LAGERS. All of LAGERS benefits use a formula that multiplies those three components together to determine your monthly benefit.

How Do Employee Contributions Work?

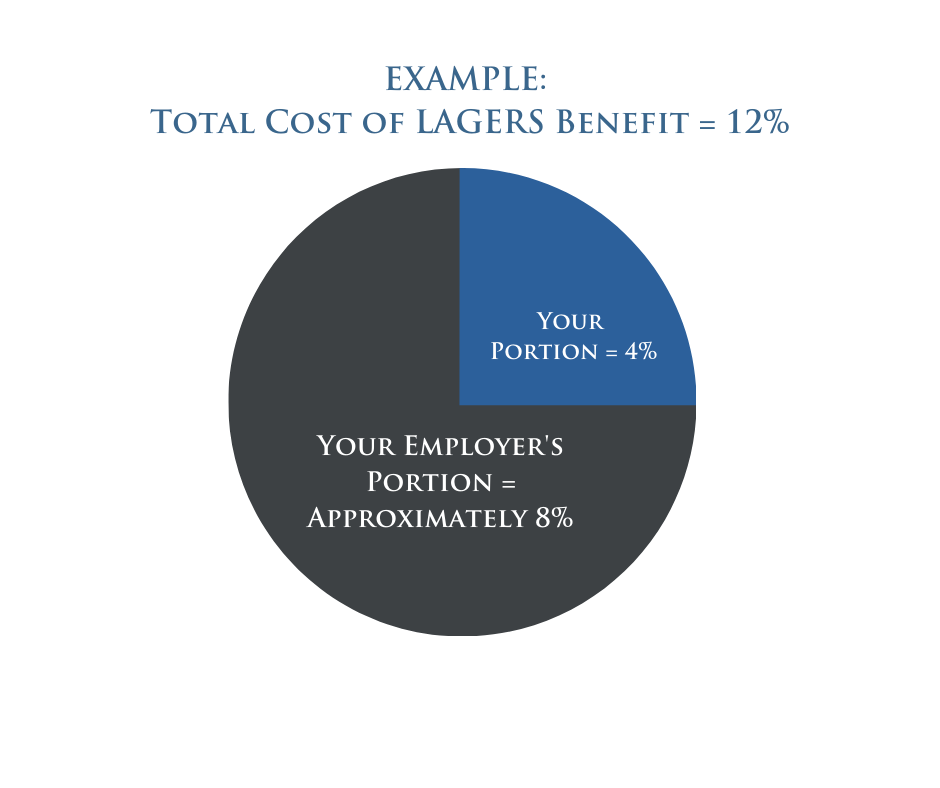

In order to provide LAGERS benefits to employees, your employer makes contributions as a percentage of your subdivision’s payroll. When an employer requires employees to contribute, you are paying a portion of the percentage of payroll needed to fund your subdivision’s benefits. For example, if the total percentage needed to fund your subdivision’s cost for providing benefits is 12% and your employer requires 4% employee contributions, you will pay 4% and your employer will pay around 8%.

why should employees contribute?

An employer has many reasons why might require employees to contribute. Among those may be to make the benefits more affordable for the subdivision. For example, if an employer would like to increase their benefit multiplier and can’t afford the full cost of the increase, they may ask their employees to contribute to help offset some of the cost. That is exactly what employee contributions are designed to do: offset some of the employer’s cost. But if the employer were to combine a benefit multiplier increase with an increase in employee contributions, it’s easy to assume that the increase in contributions aided in the employer being able to provide higher benefits. However, what increased your benefits was the increase in the multiplier – your member contributions made it more affordable for your employer to be able to provide you an increase in benefit level.

This same mechanism is true for a newer or prospective employer’s cost of joining the LAGERS system. They may choose to require employee contributions because they want to provide the benefit, but cannot afford the full cost of the percentage of payroll needed to join. So they require their employees to contribute 2%, 4%, or 6% to help offset the cost of funding the benefit. That enables them to share the cost of providing LAGERS with you, the employee who stands to benefit from having a pension. This creates more retirement security for you!

What are the benefits of contributing?

The first benefit of member contributions is that they are guaranteed to be paid back to you either through your monthly benefit at retirement, lump sum or refund of contributions. It’s also important to point out that your contributions are made after tax. So, when you retire, there will be a portion of your monthly benefit that is non-taxable.

There are definitely benefits to contributing to LAGERS, but directly increasing your benefit is not one of them. Employee contributions are designed to help your employer fund your benefits, and sometimes your employer may also increase your benefit levels with the help of your contributions.