Jeff Kempker, CEBS, CRC

-2.jpg)

Reform has been the hot topic in the world of public employee retirement plans for years. Too often the conversation immediately turns to tossing out defined benefit pensions for government workers and replacing them with individual investment accounts like 401(k)s. Supporters of the 401(k) approach say these plans are a better fit for the modern worker; they are always fully funded; they give workers control over their own money; the public sector should follow the private sector’s lead in eliminating pension plans. However, this thinking does not consider the uniqueness of public sector jobs, workers’ lack of understanding of financial products, the impact on workers’ retirement security, or the effect on the employer and taxpayers.

Public Workers Highly Value Retirement Benefits

Workers in the public sector place a high value on retirement benefits as opposed to the private sector where salary is preferred. A recent survey by the National Institute on Retirement Security (NIRS) found that almost nine in ten (88%) government workers said retirement benefits are an “extremely” or “very” important job feature compared to just 65% of private sector workers where eight in ten said salary was “extremely” or “very” important.

Public Workers Stick With the Same Employer Longer

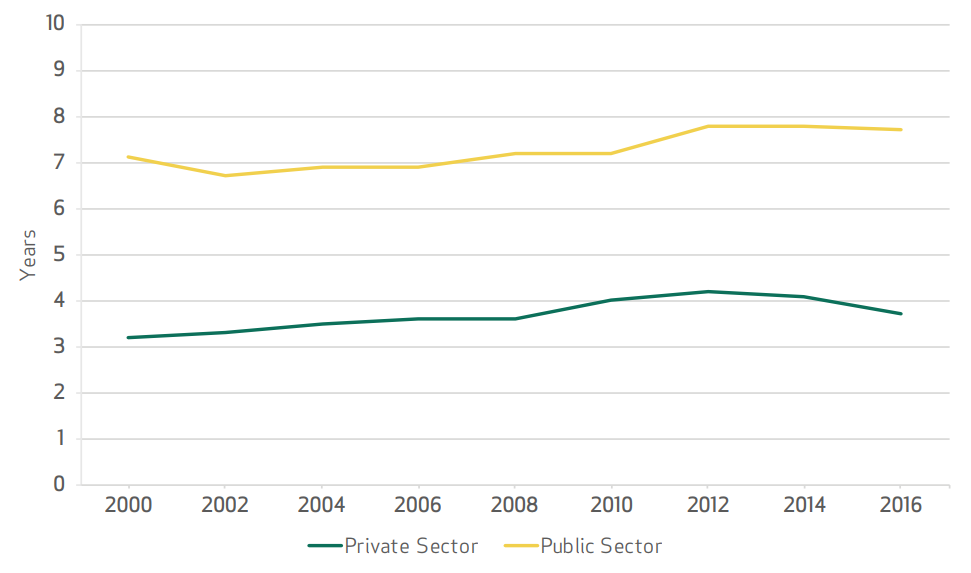

Government workers also tend to stay with the same employer about twice as long as their private sector counterparts. According to NIRS, government employees stay with the same employer for 7.7 years compared to 3.7 years for private sector employees. Low turnover in the government workforce is extremely beneficial to taxpayers who depend on essential services from experienced public workers.

Median Years of Tenure with Current Employer for Private and Public Sector Employees, 2000-2016

Public Sector Workers Face Unique Hazards

Police officers, firefighters and emergency medical crews face job hazards not found in the private sector. According to a report by the Center for State and Local Government Excellence, public safety workers view retirement benefits as the most important job feature, above salary and health insurance, because of the risks of disability and death they face serving and protecting our communities. These are also jobs where age matters, as physical performance is critical for saving lives and enforcing laws. Offering these workers a dignified exit from the workforce after a career of service helps ensure communities can provide top notch public safety.

When these Americans can no longer work, they will be forced into poverty, living off Social Security and other public assistance programs.

401(k) Plans Can Be Underfunded, Too

There is much discussion about pension plans being under funded, but under funding can also be an issue in 401(k) plans. It is well-documented that Americans are not saving enough for retirement. So much so that the U.S. Government Accountability Office recently released a report detailing the problem. Millions of Americans not only have zero retirement savings, but also have no access to a retirement plan through their employer. When these Americans can no longer work, they will be forced into poverty, living off Social Security and other public assistance programs.

Financial Literacy Among Americans is Low

Let’s face it; investing in the markets is confusing. Knowing how much to save, what to invest in, how and when to re-allocate, and then turning an account balance into a lifetime stream of payments is a daunting task for the average American worker. Today’s workers, both public and private, need help if they are going to be able to achieve financial independence in retirement. Pensions help take some of the guesswork out of retirement planning because they provide stable monthly income. Pension funds are managed by professionals, so they typically earn better returns than individuals investing on their own.

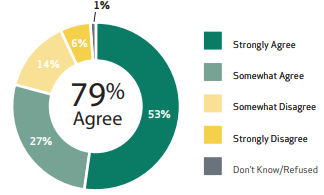

Eight in ten Americans agree the average worker cannot save enough on their own for a secure retirement.

The Private Sector Retirement System is in Shambles

Those who support moving government workers to 401(k)s say the public sector should follow the private sector’s lead in dismantling pensions. But the truth is, the retirement system for private sector workers is a mess. Only about half of these employees even have access to a retirement plan at work, and those who do aren’t saving enough. Expecting individuals to fund their own retirements by investing in the markets works best for high income Americans who are ten times more likely to have retirement savings than low income families. The truth is, asking the public sector to follow the private sector in terms of retirement security is a race to the bottom that hits low to middle income workers especially hard. The 401(k) experiment has officially failed. It’s time to look at reforms to the private sector retirement system.

Public pension reform discussions almost always trend toward throwing out the pension in favor of a 401(k) plan. Governments that have done this, like the City of Palm Beach and the state of West Virginia, experienced unintended consequences which spurred leaders to switch back to a pension plan. There is no denying some public pension plans face challenges and need to be amended to promote long term sustainability, but suggesting a switch to a 401(k) is not the answer.