Jeff Kempker, CEBS, CRC

A recent report published by the U.S. Government Accountability Office (GAO) concludes that retirement security for Americans is on shaky ground and recommends Congress do something about it.

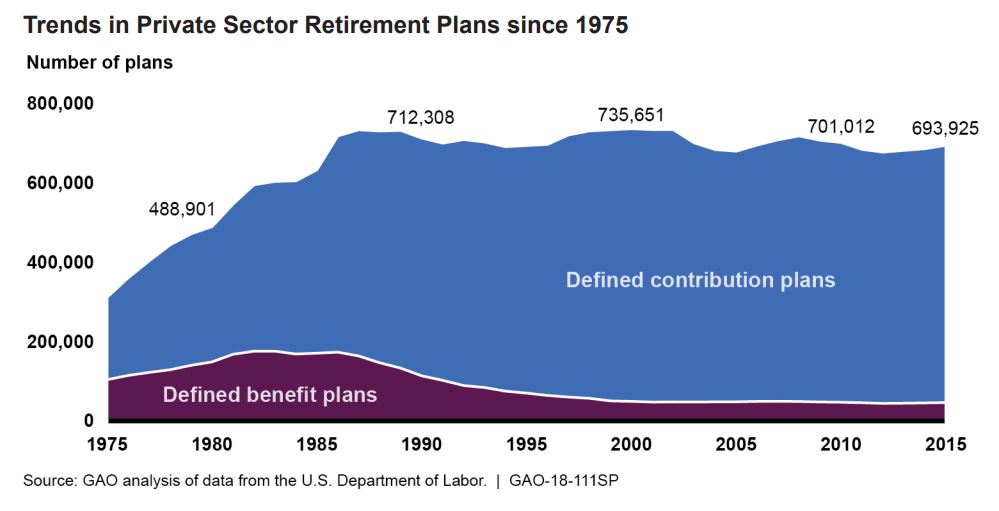

The GAO is an independent, nonpartisan agency that is commonly referred to as the “congressional watchdog” because it investigates how Congress is spending taxpayer dollars. In the report, The Nation’s Retirement System: A Comprehensive Re-evaluation Is Needed to Better Promote Future Retirement Security, the GAO points to the decline of defined benefit pension plans in the private sector as a primary contributor to the deterioration in Americans’ retirement security.

According to the GAO, retirement security is increasingly harder to achieve because individuals face more financial, societal, and demographic risks than in the past. Specifically, more workers are required to manage their own retirement accounts; a skill the GAO says, “many households are ill-equipped” to handle by themselves.

The report points out three key challenges Americans face in planning their retirement:

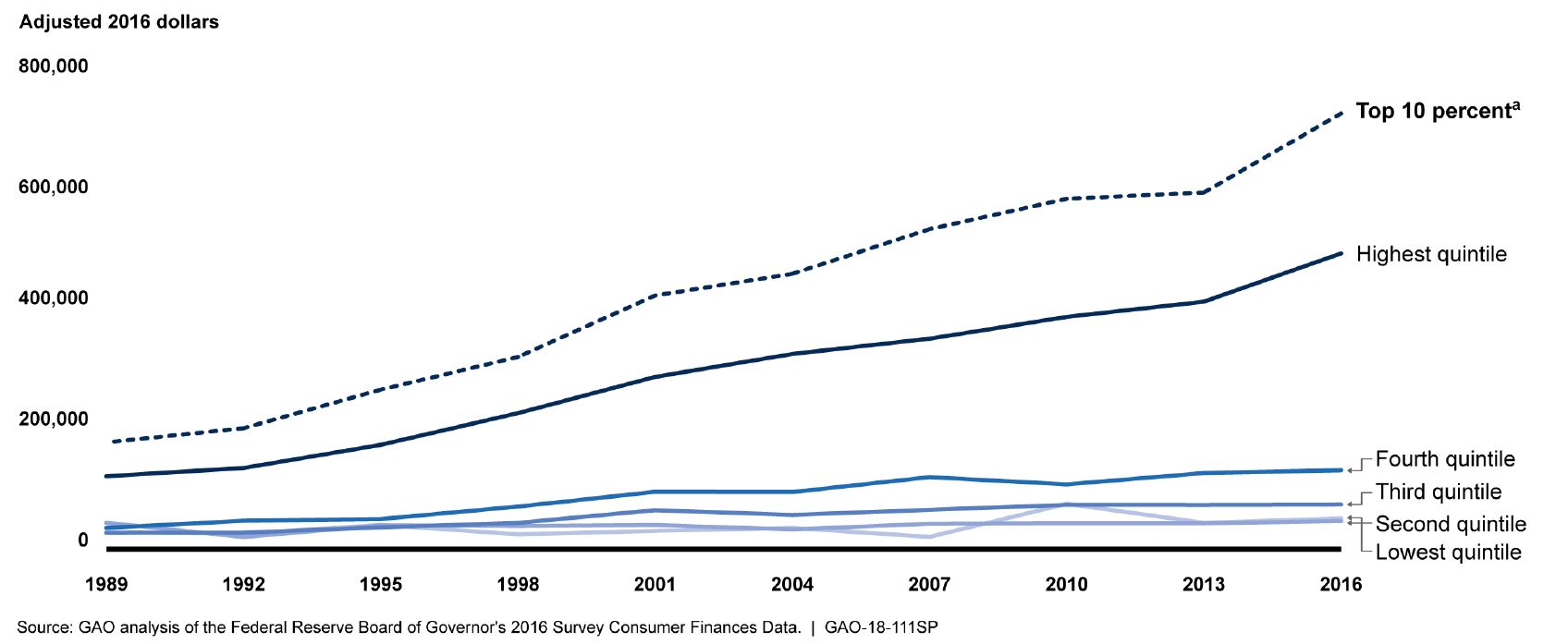

1. Access: About two-thirds of private sector workers have access to a retirement plan at work; however, only 56% of households with access to a plan participate. For those in the lowest income quartile, only one-in-four have a retirement account balance.

Households’ Average Retirement Account Balances, by Income, 1989-2016

2. Saving: Accumulating enough assets to pay expenses and maintain a decent lifestyle during retirement is difficult for the average person. Navigating the investment landscape is challenging because of all the decisions people are required to make about how much to save, choosing investments, managing risk versus return; as well as making decisions about what to do with savings when life changes occur. Help is available, but it isn’t free, and employers are reluctant to provide advice for the fear of litigation.

3. Retirement: Turning retirement savings into a stream of payments that will last a lifetime may be the most challenging. Retirees with little retirement savings will be primarily living off Social Security with additional income most likely provided through continued work. Even those with significant account balances face many difficult decisions about how best to spend down their savings while reducing the risk of running out of money before they die. Most 401(k)-type plans do not offer options for a systematic withdraw of savings and individuals tend to overestimate their future investment returns and underestimate how long they will live.

The Pillars of Retirement Security Are Deteriorating

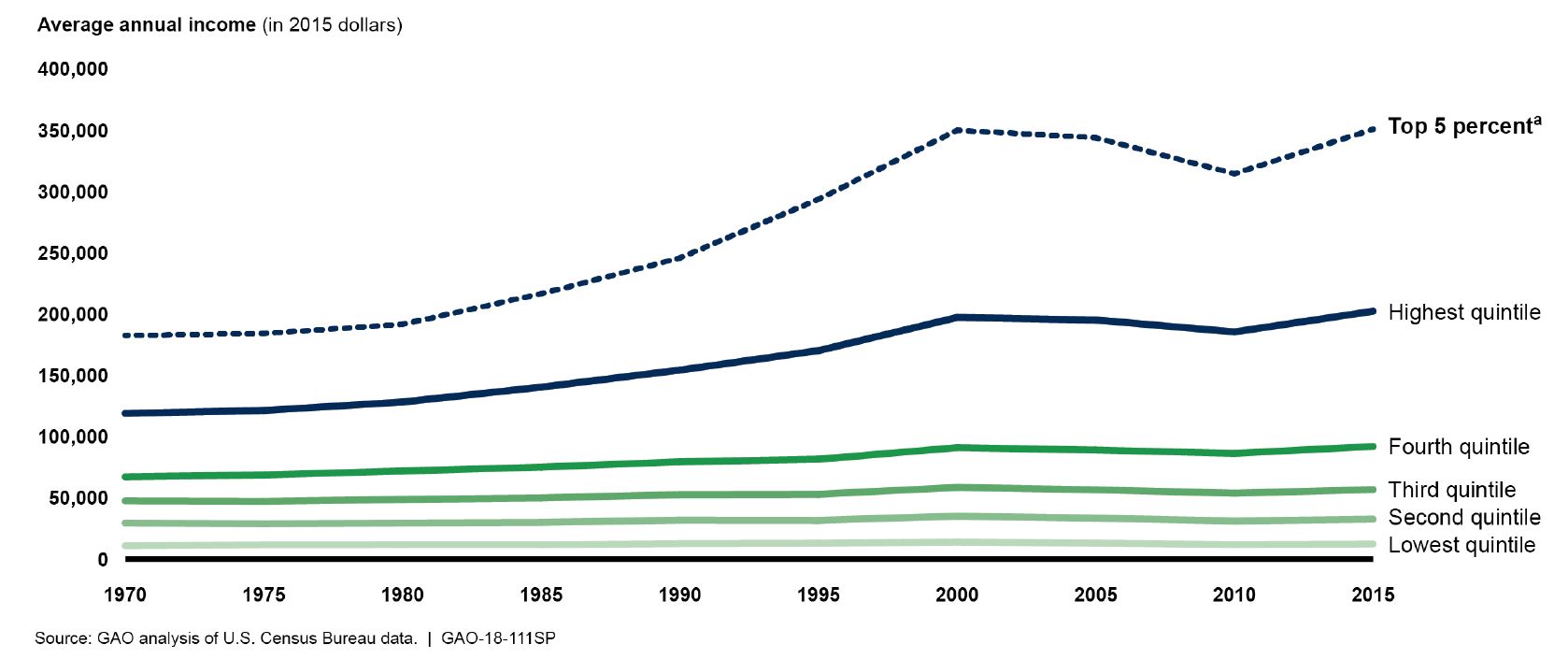

The report goes on the explain how the three pillars of the U.S. retirement system are deteriorating. First, because of the aging population, increasing longevity, and more retirees than workers, the Social Security program is expected to only be able to pay about 75% of it’s obligations by the year 2035. As for the second pillar, private-employer sponsored retirement plans, more risk is being shifted to the individual without proper knowledge or education on how to provide an adequate retirement for themselves. Individual savings, the third pillar, has seen a sharp decline over that last 40 years due to slow wage growth, increasing household debt, and rising health care costs.

Mean Household Incomes, 1970-2015

Some Good News For State & Local Government Workers

There is some good news in this report, however. Much of the GAO study focuses on workers and retirees in the private sector because this is where most of the problems are found. However, a small section of the report discusses the status of state and local government workers and points out that 93% have access to a defined benefit pension plan. And while some public pension plans have experienced difficulties since the recession of 2007-2009, many have taken steps to reduce benefits and increase contributions to put these plans back on stable financial ground. Perhaps Congress can take a look at state and local retirement plans for guidance on fixing the system for private sector workers.

Conclusion

The conclusion of the GAO report is that Congress can no longer attempt to fix the retirement crisis in the private sector using a piecemeal approach, but rather, must take a comprehensive look at all three pillars of the U.S. retirement system and implement fixes that will benefit all Americans.

The big question is, will anyone in Congress listen to the recommendations in this report and take action?