Jeff Pabst, CRC

During this time of year, we are usually focused on buying presents for our loved ones, Christmas gatherings, and drinking egg nog. You should be doing these things and enjoying the company of your friends and family – I know I will be. However, when you’re not focused on all of the holiday festivities, think about reviewing your retirement plans to ensure you’re on track.

Annually around the New Year I review my retirement savings plan. I do this to ensure I am saving enough money to meet my goal of financial independence for my future retired self. It is generally accepted throughout the retirement planning industry that you will be comfortable in retirement if you replace around 80% of your pre-retirement income. However, 80% is a general number that may not apply to you. It depends on the lifestyle you would like to live in retirement. If your lifestyle will be more expensive, you will need to replace more than 80%. Likewise, the opposite is true if your lifestyle will be more modest.

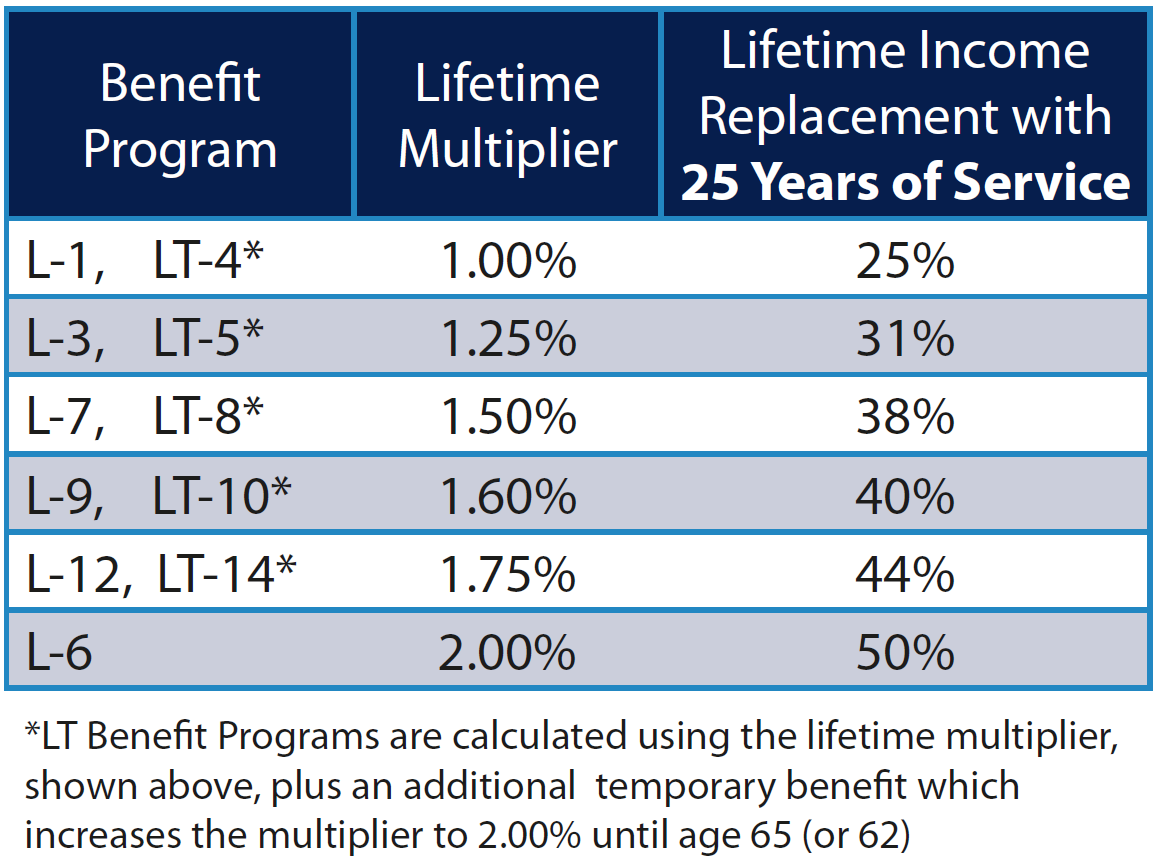

Quick Tip. There is a simple way to calculate the percentage that will be replaced by your LAGERS benefit at retirement. To complete this calculation, take the years of service you plan to work times the multiplier your employer has elected. The result of the calculation will give you the amount of your pre-retirement income that will be replaced by your LAGERS pension. At that point, you will likely realize that your pension may not cover as much as you expected. The additional necessary retirement income can come from personal savings or another source of income in retirement.

Some Available Planning Tools:

As a LAGERS member, you have a couple tools that can help you better understand what you are going to receive from your pension. The first of these tools is your member annual statement. You receive your annual statement in the first quarter every year and it shows you a couple different calculations. The first of those calculations is called “What you’ve earned as of December 31”. In other words, if you are vested and terminate employment, this calculation shows what you would receive at retirement based on your service as of December 31. Another calculation on your annual statement is a projection of your future benefit called, “What you could earn if you keep working.” This section is extremely beneficial for your retirement planning. It gives you a calculation of what to expect from your pension if you continue working until retirement age. You can view your past annual statements on myLAGERS.

Another tool that you have at your disposal at any time is the myLAGERS portal. Among other things, this online portal allows you to generate benefit estimates. The benefit estimator on the myLAGERS portal allows you the freedom of projecting your benefit to a specific retirement date with the ability to project things like salary increases and potential tax withholding of your benefit. You can generate as many estimates as you want on myLAGERS and save up to 10 of them. The estimate also illustrates all of the different payment options available within the LAGERS system. Additionally, the myLAGERS portal allows you to apply for your retirement benefit, change your personal information, estimate a purchase of service and much more.

When considering your savings plans, there are several sites out there that can provide you retirement planning tools to assist you in projecting your retirement savings and income. Some of you may have these tools available through your Defined Contribution (457) provider. I personally use a couple of online tools from my Defined Contribution (457) provider and 360degreefinancialliteracy.org. Specifically, I utilize their projection tools that allow me to enter information about my pension, Social Security, and my current savings plan. These types of retirement planning tools are an excellent way of evaluating your current plan and whether or not you need to increase your retirement savings.

I know some of you may be saying that I cannot afford to save for retirement for one reason of another. I can completely understand and relate because I have two children in daycare. As many of you know, daycare is incredibly expensive. Yet, I am able to save a little bit of my paycheck every month to help ensure that I am going to be able to retire comfortably. It’s not a large amount of savings, just a small amount. Secondly, if your employer is offering you a match program, it’s like they are paying you to save money. So, if you can afford it, save at least up to the match amount.

If you are already saving, that’s great! Now is a good time to review your savings plan and make adjustments, if needed. On the other hand, if you are not already saving, what a wonderful way to start the New Year and embark on the path of creating financial independence for your future self.

Jeff Pabst, CRC Senior Communications Specialist

Jeff Pabst, CRC Senior Communications Specialist