Angela Lechtenberg, APR

If your employer has elected the Rule of 80 option for your LAGERS retirement benefit, you have another option for when you can retire and collect your benefit.

If your employer has elected the Rule of 80 option for your LAGERS retirement benefit, you have another option for when you can retire and collect your benefit.

With the Rule of 80, when your age plus service credit (or time you’ve worked in LAGERS covered employment) equals 80, you can retire with no reduction in your benefit. This is not the same as LAGERS’ early retirement option, which does reduce your benefit depending on how early you decide to retire, before normal retirement age.

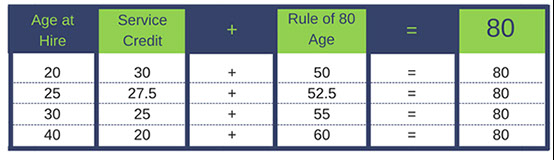

Here’s how Rule of 80 works:

If you start your career with a LAGERS covered employer at 20 and work for 30 years, your Rule of 80 age is 50. If you start working for a LAGERS employer at 25, and work for 27.5 years, your Rule of 80 age is 52.5, and so on. At LAGERS we do everything on a month to month basis, so make sure that your months of service plus your age equals 80.

Here are some questions we get about the Rule of 80:

“But if I start work after age 40? Do I have to work past normal retirement age to get to my rule of 80 age?” If I start work at age 43, my Rule of 80 age is 61.5! The answer is no. We don’t penalize you for starting work in LAGERS covered employment after age 40. You can still retire at normal retirement age (or take the early retirement option) .

“What if I quit before my rule of 80 age? Can I still draw my benefit at my Rule of 80 Age? My Rule of 80 age is 54, but I plan to leave at 52.” No. You must work up until your Rule of 80 date in order to retire at that date.

“Does my previous employment count towards my Rule of 80? They were covered by LAGERS, but they didn’t have the Rule of 80 option.” Yes. Any time that you have worked under LAGERS may count towards your rule of 80 requirement as long as you work at your current employer until your Rule of 80 age. However, you won’t be able to collect the benefit earned at the non-Rule of 80 employer until you reach regular retirement age (or you take the early retirement option and get your benefit reduced).

Don’t know if your employer has elected the Rule of 80? Check with your benefits liaison in your HR department or contact a LAGERS benefit specialist to find out.